If you’re looking for “where can I sell my note fast”, you aren’t alone. Selling your note for quick cash can make all the difference when life demands financial flexibility. For note holders, getting paid without waiting years for small payments just makes sense.

This article is for anyone ready to convert a promissory note into a lump sum. You’ll discover why speed matters, how to stay safe through the process, and the top sites and direct buyers for a smooth transaction. Answering how do I sell my note will protect your money, interests, and connect you to the right buyer at the right time.

Skip the guesswork and figure out the answer to how do I sell my note. This guide will give you trusted platforms and approaches so you can choose with confidence. For more background before you start, visit this deep dive on the promissory note basics and selling tips.

📌 Key Takeaways to Sell My Note

- Safety First: Insist on written agreements, avoid upfront fees, and use escrow services to protect your interests during closing.

- Speed is Possible: Selling your note fast is realistic when you work with direct buyers or trusted platforms that specialize in quick appraisals and streamlined offers.

- Choose Reputable Buyers: Use companies with solid reputations, verified credentials, and transparent processes to avoid scams and low-ball bids. Avoid asking yourself later “Why did I sell my note to that company?”

- Have Documents Ready: A complete and organized note package (payment history, original note, ID) dramatically improves your chances of a fast and fair sale.

- Compare Multiple Offers: Never settle on the first bid—comparing 2–3 quotes helps you spot better payouts and avoid hidden fees.

- Direct Buyers = Quick Cash: If you need money fast, skip marketplaces and brokers and go straight to vetted direct buyers with funds on hand.

spacer

spacer

Speed Matters—And It’s Achievable

- Prompt transactions are possible when you use top sites that specialize in buying promissory notes. Established platforms have systems in place for fast appraisal and offers.

- Direct note buyers and reputable online marketplaces can often present a cash offer within days, giving you flexibility and peace of mind.

- Multiple platforms, like ours who buys promissory notes, offer clear, step-by-step selling processes so you aren’t stuck guessing how long it’ll take.

Photo by Anna Nekrashevich

Photo by Anna Nekrashevich

Choosing Trusted Buyer Platforms

- Opt for buyers with strong reputations for honesty, fair pricing, and proven experience. Research online reviews and Better Business Bureau ratings.

- Platforms featuring direct buyers are recognized for their reliability when it comes to selling notes fast.

- Confirm that any site you use specializes in your type of note for smoother communication and fewer hold-ups.

Getting a Fair Offer

- Each buyer may have a unique formula for pricing, but competitive buyers are transparent about how they value your note.

- Fast offers don’t have to mean low-ball bids. With preparation and a bit of research, you can spot the best deal quickly—especially if you check a couple of sites before picking one.

- For insight into how selling a promissory note can support your financial goals, see this guide on the benefits of selling a promissory note.

Preparation Makes a Difference

To get the best result, make sure you:

- Gather your paperwork, including the original note, payment history, and any supporting legal documents.

- Know your payoff amount and the remaining balance so you’re ready for quick, precise conversations.

- If you’re looking to move fast, companies that advertise speed—like those who give a direct cash offer for your promissory note—are your best bet when thinking sell my note.

Why “Where Can I Sell My Note” is the Right Question

- Selling your promissory note isn’t just about finding any buyer—it’s about finding the right buyer, one who values your asset correctly and pays quickly.

- With trusted platforms and direct buyers, your cash isn’t far away. Position yourself for success by focusing on places with a proven track record and clear communication.

- For additional strategies and insights on navigating the process smoothly, you can get more tips from the latest insights and tips on notes.

Smart preparation and knowing where to look can save you time and stress—and help you get the outcome you want.

Understanding the Process: How to Sell a Promissory Note Fast

Selling your promissory note quickly means you need to balance speed with accuracy. Rushing without proper prep can lead to delays or missed opportunities. Let’s break down what it takes to move your note fast—without unnecessary stress or confusion.

Preparing for a Quick Sale: Documentation and Valuation

The best way to get a quick sale is to have your paperwork ready and know your note’s value before reaching out to buyers. Here’s what you’ll need to sell your note and what to watch for:

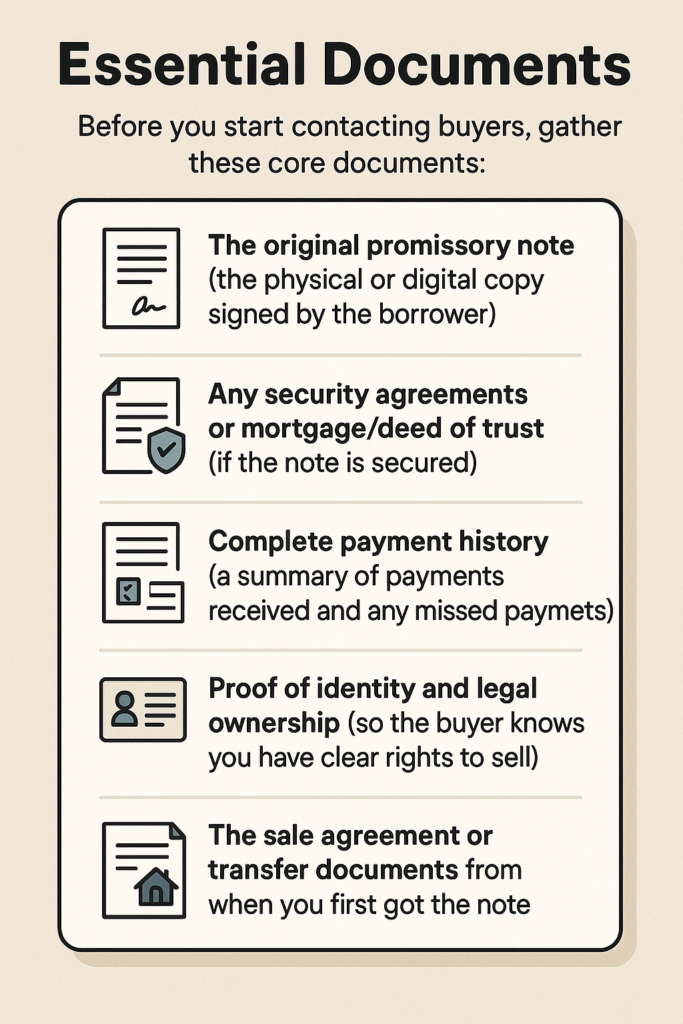

Essential Documents:

Before you start contacting buyers, gather these core documents:

- The original promissory note (the physical or digital copy signed by the borrower)

- Any security agreements or mortgage/deed of trust (if the note is secured)

- Complete payment history (a summary of payments received and any missed payments)

- Proof of identity and legal ownership (so the buyer knows you have clear rights to sell)

- The sale agreement or transfer documents from when you first got the note

How Valuation Works:

Buyers look at several factors to decide how much they’ll pay for your note:

- Outstanding principal balance

- Payment history and timeliness

- Interest rate on the note

- Remaining term (how long until it’s fully paid off)

- Creditworthiness of the borrower

- The note’s security (for example, if it’s backed by real estate)

- Local laws and market demand

If your paperwork is incomplete, or the terms are unclear, buyers may walk away or lower their offer. Double-check that all signatures match, pages are included, and there are no gaps in the payment record.

Common Mistakes That Slow Down Sales:

- Missing original documents or unclear copies

- Gaps in the payment log or missing details on borrower info

- Not getting a payoff statement, especially for larger notes

- Failing to check for legal issues, like outstanding liens or disputes

Tidy paperwork and honest, upfront details will save time and help you lock in a fast sale. For a deeper dive on prepping your documents, visit Promissory Note Sales Insights.

The Step-by-Step Sale Journey

If you want to move from “sell my note” to “deal closed,” you need a simple process. Here’s how the sell my note process plays out for most quick transactions:

- Prep Your Paperwork:

Organize all docs, confirm legal ownership, and check for any missing signatures. - Get a Valuation or Offers:

Reach out to buyers or sites—some will provide instant quotes, while others may need to review documents first. - Negotiate Terms if Needed:

Compare offers. Some buyers may match or beat others if you bring a competing quote. - Sign a Purchase Agreement:

The buyer will send simple paperwork that lays out terms, transfer details, and payment. - Due Diligence:

The buyer verifies the note and supporting details (this usually takes just a few days when documents are ready). - Close and Get Paid:

Once everything checks out, you sign the assignment of the note and get your cash—often via wire transfer or overnight check.

For a more detailed, step-by-step breakdown, check out Sell My Note Fast, which covers the full process for getting your note sold quickly and efficiently.

Keeping the process simple and your documents organized is the best way to avoid delays or last-minute surprises. Understanding what buyers need can turn weeks of waiting into a cash payout in days.

Sell my note today.

Top Places to Sell Your Promissory Note Online

If you’re wanting to know “where can I sell my promissory note” and hoping for a quick sale, the internet offers several trusted paths. Today, most people choose between direct buyer websites, online marketplaces, or connecting with a specialist broker. Here’s how each option works—what you need to know to move fast and make a smart decision.

Direct Buyer Websites and Note Investors

Photo by Ivan Samkov

Direct buyer sites cut out the middleman and buy promissory notes for cash. These buyers are often specialists or investors who understand how to value your note quickly.

When you use a direct buyer or note investor platform, you fill out a simple form with your note’s details. They review your documents—sometimes within hours—and make an offer. If you accept, you get paid shortly after all paperwork clears, often within days.

Why direct buyers are preferred for quick cash:

- No waiting for an offer to sell my note.

- Clear, fast approvals—some sites even guarantee a response within 24 hours.

- Less uncertainty about selling my note and closing; buyers are ready with funds.

- Fewer steps these sites perfect if you’re looking for speed over shopping for the highest price.

This option is ideal when you need funds right away or want a straightforward transaction. If a direct sell my note deal is the goal, check out a cash offer for your promissory note now.

Online Marketplaces: Peer-to-Peer and Auction Sites

Selling a promissory note online through a marketplace or auction site works differently. Here, you post the details of your note, and multiple buyers can bid or negotiate directly with you. These platforms are often peer-to-peer, connecting everyday sellers to professional investors. You have to think, do I want to sell my note to a proven company or an individual?

Pros:

- Potential for multiple offers, which could drive up the price.

- Access to a wide network of buyers with different needs.

- Control over who you sell to; you can vet prospects or set a minimum price.

Cons:

- Sales can take longer—listing, waiting for bids, and fielding questions takes more time.

- You’ll need to prepare your documents and may need to answer due diligence questions directly.

- Some sites have listing fees or commissions on the final sale.

Typical requirements:

Most marketplaces require:

- Full ownership and clear title to the note.

- Recent payment history and accurate documentation.

- Willingness to disclose terms to interested buyers.

Who benefits most?

Online marketplaces suit sellers who aren’t in a hurry and want a shot at a higher price. If you are patient and want to maximize value, these are worth a look.

When considering where can I sell my promissory note in a public forum, review each marketplace’s reputation and support systems. You also want to make sure your buyer funds are secure before you transfer ownership.

Specialty Brokers and Expert Services

Some sellers want more support or have a complicated note. That’s where specialty brokers and expert services come in. Note brokers act as intermediaries between sellers and buyers. They know how to price notes, market them, and handle all the paperwork.

What note brokers do:

- Assess your note and suggest a realistic pricing range.

- Handle marketing, targeting both private and institutional buyers.

- Negotiate terms and manage offers, helping you decide which is best.

- Guide you through the paperwork and coordinate the closing, reducing your risk of errors.

When is a broker your best choice?

- You have a unique or high-value note.

- You face questions about legal details, ownership, or collateral and need help explaining or fixing them.

- You want hands-off support at every step.

Tips for choosing a reputable expert:

- Look for experience—years in business and strong client feedback matter.

- Check that they are transparent about fees and the process.

- Avoid anyone pushing for exclusive agreements without showing real proof of results.

Working with a trusted expert can make your sale feel less risky, especially if you haven’t sold a promissory note before.

Trying to decide which path is right for you? Check out these answers to common selling questions to see what fits your needs. Each approach has its perks depending on how fast you want to move and how much support you want along the way.

Key Tips to Maximize Your Payout and Avoid Scams

When you ask, “where can I sell my promissory note,” getting the best deal and staying safe should go hand in hand. The right strategy helps you boost your cash payout and avoid headaches from scams or costly mistakes. Follow these tips to keep your sale quick, profitable, and secure.

Comparing Offers and Understanding Fees

Not all buyers value promissory notes the same way. Taking a little extra time to compare your options pays off—literally. Offers can vary due to buyer preferences, perceived risk, and company fee structures.

Here’s how to get the upper hand:

- Request multiple quotes: Never settle for the first offer. Get at least two or three to spot low-ball bids.

- Ask for fee breakdowns: Understand every deduction taken from your payout. Some buyers build in appraisal, processing, or “transfer” fees that shrink your check.

- Look at the true net payout: Focus on what actually hits your bank, not just the headline offer.

- Check for early payoff clauses: If your note can pay off ahead of schedule, see how that would impact your price.

- Communicate with buyers: Honest companies answer your questions clearly and won’t pressure you.

Photo by Tobias Dziuba

Photo by Tobias Dziuba

Comparing terms keeps you in the driver’s seat and protects you from hidden costs. To understand what affects offer amounts, this overview of promissory notes and how they work cuts through the jargon.

If selling locally, a resource like Selling Promissory Notes in Lansing gives step-by-step insights to make sure you spot all potential fees or hidden fine print.

Ensuring a Safe and Legally Sound Transaction

Selling your note safely is just as important as getting a good price. Scams, shady buyers, or legal pitfalls can ruin the experience if you’re not careful.

Stay ahead of trouble by:

- Vet every buyer: Look for long-standing businesses with positive online reviews, Better Business Bureau profiles, and a real physical address.

- Demand written agreements: Every step—offer, sale, and transfer—should be documented and signed. Never rely on a handshake or phone promise.

- Check buyer credentials: Ask for proof of funds and references from past sellers.

- Use professional help: For complex or high-value notes, involve a real estate attorney or financial advisor.

- Never pay upfront fees: Legitimate buyers don’t require payment before you’re paid.

- Insist on escrow for closing: An independent escrow service protects both parties and controls the money until final paperwork is done.

Watch for red flags, like a buyer dodging your questions or pushing you to move faster than you feel comfortable. For more, FINRA offers direct advice in their alert on promissory note safety for investors.

Mistakes to Avoid When Selling My Note

A rushed or careless sale can lead to regrets—lost money, legal headaches, or even total loss of your note’s value. Here are the missteps you want to sidestep:

- Selling to unverified buyers: Scammers often act fast and seem legitimate. Always research before sending any documents.

- Ignoring fee details: Some sellers get stuck with surprise deductions. Always request an itemized list of costs in writing.

- Missing legal paperwork: Incomplete assignments or poor documentation can block your sale or even lead to lawsuits.

- Rushing under pressure: Urgency shouldn’t force you to skip research. A legitimate buyer won’t push for a quick signature without full disclosure.

To help steer clear of these traps, check out how to sell your mortgage note—it’s loaded with tips for first-timers and seasoned sellers alike.

Smart, safe moves mean you’ll get a better offer, avoid risky buyers, and sell your promissory note fast without future headaches.

Conclusion

Finding where you can sell your promissory note quickly depends on what matters most—speed, price, or hands-on support. Direct buyers stand out if you need cash fast and want a simple, no-nonsense process. Online marketplaces offer more choice and the chance for competing bids, while expert brokers are a fit if your note is unique or you want extra guidance.

Use clear documentation and compare offers closely for the best outcome. The right platform can turn a drawn-out waiting game into quick cash with minimal stress. A little research upfront helps you avoid scams and get a fair deal.

Ready to take the next step? Review this detailed list of companies purchasing promissory notes so you can match your needs with reputable buyers. Choosing well makes all the difference—turn your promissory note into financial freedom, your way.