Key Points About a Secured Promissory Note

- Secured promissory notes use collateral to reduce risk, making them more valuable and easier to sell than unsecured notes.

- Unsecured promissory notes lack asset backing, so they carry higher risk, lower market value, and often require stronger borrower credit.

- Selling any promissory note requires clear documentation and a good payment history to attract buyers and get the best price.

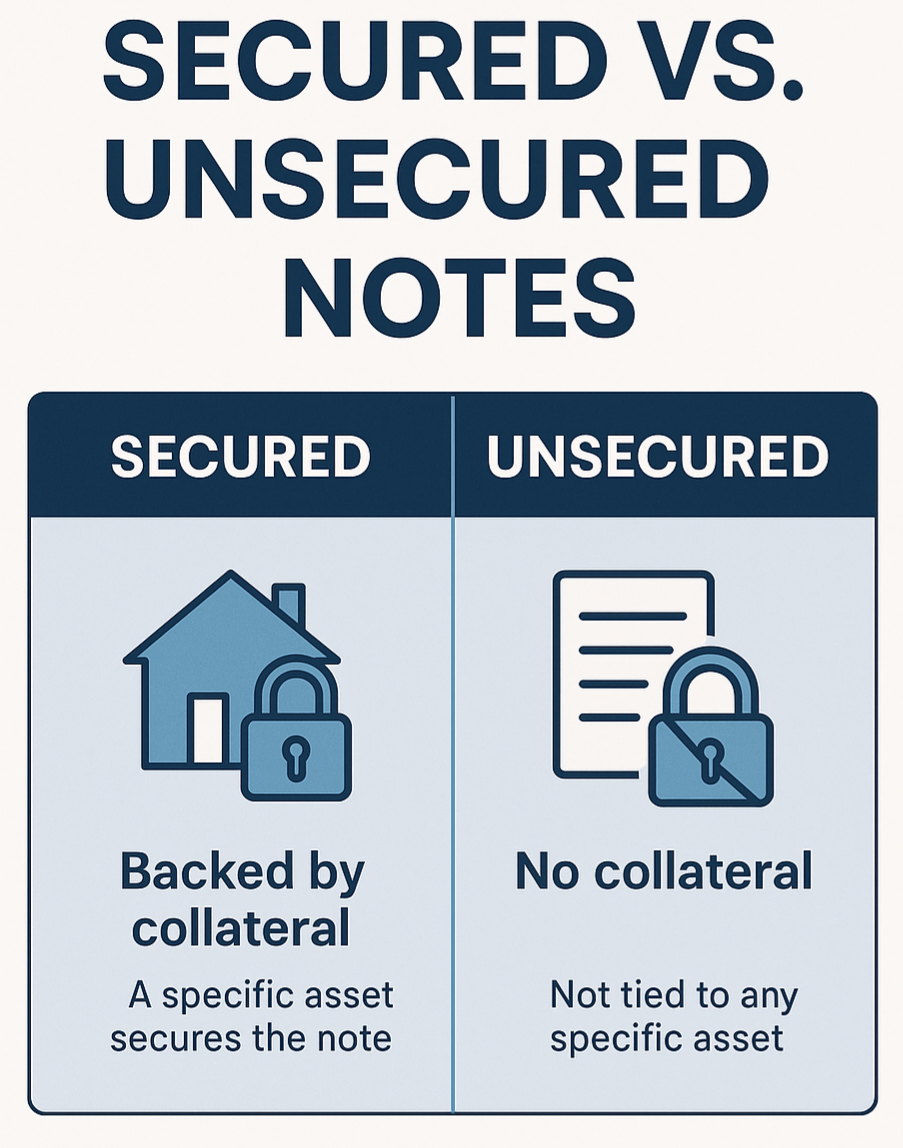

Selling a promissory note isn’t just about getting a payout. The type of note you hold—a secured promissory note or unsecured—makes all the difference for sellers. The main dividing line comes down to collateral. A secured promissory note is backed by assets that help lower risk, while an unsecured note doesn’t include this protection.

Understanding this difference helps you set fair terms, attract more buyers, and protect your interests. If you’re a note holder looking to sell, knowing if your note is secured or not shapes your options, value, and the speed of your sale. You’ll see why collateral can sometimes be the deciding factor in whether a deal succeeds or stalls.

Watch this video for more insights: https://www.youtube.com/watch?v=lWU_F7xgFyA

Promissory Notes Explained

Photo by Matthias Zomer

Photo by Matthias Zomer

When you hold a promissory note, you own a legal contract that defines a borrower’s promise to pay back a loaned sum. These notes form the backbone of many private lending transactions, giving clear terms for repayment and, in the case of a secured promissory note, potential legal remedies if the borrower defaults. Understanding the basics of promissory notes sets a strong foundation for anyone looking to sell or manage this kind of asset.

What Is a Promissory Note?

A promissory note is a written agreement where one person promises to pay a specific amount of money to another, either on demand or at a set time in the future. This isn’t just a casual IOU between friends. A promissory note is legally binding and enforceable in court, which means both parties have real obligations and rights built in from the start.

If you want the technical definition, a promissory note is considered a “negotiable instrument.” This means it can be transferred or sold to another party. For many, a promissory note can be as important as holding cash, because it spells out how and when the money comes back with interest. For a deeper legal definition and examples, you can check this overview of promissory notes on the Legal Information Institute.

Legal Function of a Promissory Note

The core job of a promissory note is to give each side clarity and protection. The borrower agrees in writing to pay the lender a fixed sum, often with scheduled payments and interest. The lender gets legal proof of the debt and the right to pursue collection if the borrower stops paying.

Promissory notes make the repayment timeline, the loan’s interest rate, and any late fees crystal clear. They also reduce misunderstandings—what’s agreed to on paper can be enforced if needed.

- Enforceability: Since promissory notes are legal contracts, note holders have the right to take legal action if payments stop.

- Transferability: Sellers can assign or sell a promissory note to another party, turning future payments into immediate cash.

- Negotiability: Promissory notes can be traded, making them valuable assets in personal lending and business financing.

For more practical insight into their legal use, review examples and uses of promissory notes at LegalZoom.

Main Components of a Promissory Note

A solid promissory note contains essential details to make the agreement fair and binding. These components protect both sides and prevent disputes.

Standard promissory note elements include:

- Principal Amount: The original sum loaned to the borrower.

- Interest Rate: The stated rate and whether it’s fixed or variable.

- Payment Schedule: When payments occur and in what amounts.

- Maturity Date: The final due date for loan repayment.

- Parties’ Names: Full names of the lender (payee) and borrower (maker).

- Signature(s): Both parties must sign for enforceability.

- Collateral Description (for a secured promissory note): Outlines the asset tied to the debt. If the borrower defaults, the lender can claim this asset.

When a note lacks collateral, it’s “unsecured.” If it’s tied to something of value—a home, car, or another asset—you have a “secured note.” This key fact impacts the safety and value of the note for sellers. For a helpful breakdown of these features and their importance, check this comprehensive guide to promissory notes at Investopedia.

A clear promissory note isn’t just paperwork; it’s real power for anyone lending or selling private debt. Understanding these core concepts lets note holders act with confidence.

Secured Promissory Notes: Features and Benefits

A secured promissory note gives both lenders and note holders an extra layer of confidence. It uses tangible assets as a safety net, which reduces financial risk and can increase a note’s appeal to potential buyers. When you understand how collateral, security agreements, and perfection steps come together, you put yourself in a stronger position, whether you plan to sell the note or keep it for regular income.

How Secured Promissory Notes Work: Collateral, Security Agreements, and Perfection

Secured promissory notes aren’t just a promise on paper. Backed by property or assets, it includes a security agreement, which spells out the details of what asset secures the loan if the borrower defaults. This agreement can cover anything valuable that the lender and borrower agree on.

Once the security agreement is in place, lenders often “perfect” their interest. This means they legally establish their right to the collateral, usually by filing a UCC-1 Financing Statement (Uniform Commercial Code), making their claim public record.

Key steps in how a secured promissory notes work:

- Collateral: An asset—like real estate, equipment, or vehicles—backs the debt.

- Security Agreement: A contract that outlines each party’s rights regarding the collateral.

- Perfection: Filing legal paperwork (such as a UCC-1) with government agencies to secure the lender’s claim.

This process helps ensure that, in the event of a default, the note holder has a clear, prioritized claim on the pledged asset. For more, review this template for secured promissory notes.

Advantages of Secured Promissory Notes for Note Holders

Holding a secured promissory note offers several compelling upsides:

- Reduced Risk of Loss: If the borrower fails to pay, the lender can seize the collateral to recoup value.

- Higher Resale Value: Buyers pay a premium for notes backed by valuable assets, increasing liquidity if you decide to sell.

- Easier Legal Recourse: The note holder has clear legal rights to the asset, so recovery can be faster and less complicated.

- Greater Bargaining Power: A secured debt position can make negotiating terms or sale agreements simpler.

These benefits can have a big impact on both the security and market value of your note. Lenders and sellers both prefer notes where the risk is minimized and collection is straightforward. If you’d like more legal insight, check the in-depth explanation of secured and unsecured notes.

Common Assets Used as Collateral

Different assets can secure a promissory note, each affecting the note’s value and risk profile in a unique way.

Photo by Tima Miroshnichenko

Photo by Tima Miroshnichenko

Typical forms of collateral include:

- Real Estate: Homes, commercial properties, or land are among the most valuable and stable forms of backing.

- Vehicles: Cars, trucks, or specialty vehicles offer moderate security if properly documented.

- Business Equipment: Machinery, computers, or inventory may be pledged, but values can fluctuate over time.

- Personal Assets: Jewelry, art, or collectibles are less common but possible with clear ownership and valuation.

- Cash or Investments: Bonds, savings accounts, or stocks can also be used, adding immediate liquidity.

The type and value of the collateral significantly influence the note’s risk and resale potential. The stronger the asset, the greater the confidence buyers place in the note. For more on which assets are most commonly used and why, check out this useful resource on promissory note collateral.

Choosing the right collateral not only protects you as a note holder but can also make your note more attractive to secondary buyers if you decide to sell down the line.

Unsecured Promissory Note: Features and Risks

Unsecured promissory notes operate on trust and legal promise rather than a safety net of assets. If you’re weighing whether to sell or hold an unsecured note, it’s critical to understand how these agreements work, what sets them apart, and why buyers approach them with caution. While they may offer flexibility, the lack of collateral introduces more potential hazards you need to factor in.

What Sets Unsecured Promissory Notes Apart

An unsecured promissory note relies entirely on the borrower’s credibility and a simple contractual promise to repay.

- No Collateral Required: Unlike a secured promissory note, unsecured notes are not tied to any physical asset or property. If the borrower defaults, there’s no automatic right for the lender to seize an asset to recover losses.

- Dependence on Borrower’s Reputation: Lenders must carefully evaluate the borrower’s creditworthiness. The trust in repayment rests on factors like income or credit history.

- Legal Recourse Is Limited: If the borrower stops making payments, the lender may pursue legal action for collection, but the process is often longer and may not result in full recovery.

Unsecured notes focus on the borrower’s good faith rather than asset backing, which creates a different risk profile than secured promissory notes. For a thorough breakdown of these differences, check the section on unsecured promissory note features.

Drawbacks and Considerations

Without collateral, unsecured promissory notes come with certain risks that can undercut their value if you want to sell.

- Higher Interest Rates: Lenders often charge more to offset the chance of loss, but this can make the note less attractive to some buyers.

- Default Risk Increases: If the borrower can’t or won’t pay, legal action can take time. There’s no guarantee of recovering your money, even with a court judgment.

- Challenges When Selling: Buyers scrutinize unsecured notes closely. They often worry about the increased risk of nonpayment and difficulty with collections, which can lower the note’s resale value.

If you’re considering using or selling an unsecured promissory note, see this guide to the pros and cons of using an unsecured promissory note.

Common Scenarios for Unsecured Notes

Unsecured promissory notes show up in everyday lending situations. They’re common in arrangements where trust, speed, or convenience outweigh the need for asset backing.

Some real-world examples include:

- Family or Friends Loans: Short-term funds between relatives or close friends often use a basic unsecured note.

- Personal Loans: Individuals seeking quick cash for home repairs, education, or debt consolidation may sign unsecured notes, especially if the sums are modest.

- Short-Term Business or Bridge Loans: When a business needs immediate liquidity and formal collateral isn’t available, lenders may offer an unsecured agreement, relying on the business’s reputation.

- Peer-to-Peer Lending: Online lending platforms frequently rely on unsecured promissory notes for loans between individuals.

Each of these situations trades the safety net of collateral for simplicity and flexibility, but not all buyers are comfortable with that trade-off. For more nuanced insight into why investors weigh unsecured notes carefully, see Investopedia’s promissory note overview.

Key Differences: Secured vs. Unsecured Promissory Notes

Choosing between a secured note and an unsecured one impacts your risk, your recovery rights, and the value you’ll get if you decide to sell. These two note types aren’t created equal, especially when you peek under the hood at how they’re protected, who they attract, and how easily you can sell them. Let’s break down the specific ways these differences show up for sellers.

Collateral, Legal Rights, and Recovery

With secured promissory notes, collateral is your insurance policy. If the borrower fails to pay, the lender can legally collect the asset listed in the agreement—whether it’s property, a vehicle, or another valuable item. This pledge offers real teeth to your contract.

Photo by Jonathan Borba

Photo by Jonathan Borba

In secured notes:

- The lender has priority claim on the asset, streamlining the path to recover losses.

- If the borrower defaults, the lender can seize and liquidate the collateral to cover the unpaid balance, often before any other creditors have their turn.

- Legal action is more effective because there’s something tangible to recover.

Unsecured notes don’t have an asset tied to them. Instead:

- The only “backup” is the borrower’s promise and perhaps their reputation or credit score.

- If things go wrong, collecting on a defaulted note usually means a lengthy court process—and the result can depend on the borrower’s ability or willingness to pay.

- The lack of collateral can mean competing with other creditors, making it less likely you’ll get paid back quickly or in full.

Look deeper into legal rights and collection steps with this resource on enforcing a promissory note.

Interest Rates, Terms, and Borrower Profile

The interest rates and terms in secured and unsecured promissory notes can look very different, and the type of borrower matters.

Secured notes:

- Lower interest rates tend to be standard. Why? Lower risk for the lender, thanks to the asset as backup.

- Terms are often longer and more favorable to the borrower, making repayment predictable and the note appealing to buyers.

- Lenders can work with borrowers who have weaker credit, since collateral reduces risk.

- Structured payment plans and deadlines keep things organized.

Unsecured notes:

- Rates climb higher because there’s more risk. The lender needs to be compensated for the lack of a safety net.

- Borrowers with strong credit get the best shot at approval. Lenders weigh past history, income, and even personal relationships.

- Flexible terms and shorter repayment periods are common, helping to reduce the lender’s risk.

For a visual breakdown of note terms and factors, check out Investopedia’s promissory note overview.

Impact on Note Sale and Market Value

How easily you can sell a promissory note—and the price you’ll get—will depend a lot on whether it’s secured or unsecured.

Secured promissory notes:

- Sell faster and at higher prices. Buyers love security. It often means a smaller discount off face value when selling.

- The value is backed by the collateral. Even if the borrower defaults, the asset can be sold, reducing risk for the buyer.

- Buyers may compete for well-secured notes, especially if the underlying collateral is stable, like real estate or vehicles.

Unsecured notes:

- Usually sell at a steeper discount. It’s much harder to convince a buyer that payments will come in.

- Note buyers scrutinize borrower credit and payment history to judge risk.

- Market value drops if the borrower has missed payments, seems unreliable, or if the economic climate makes unsecured debt less appealing.

For deeper context on sale value shifts, see this article on mortgage note market value.

The type of promissory note you hold sets the tone for how easy it’ll be to sell—secured promissory notes nearly always put sellers in a stronger position.

Best Practices for Selling Your Promissory Note

Selling your promissory note can unlock fast liquidity, but you’ll only get top dollar if you approach the sale with professionalism. Whether you hold a secured promissory note or an unsecured one, buyers expect a clean record, clear proof of performance, and full legal documentation. Let’s go through the steps that set you up for a confident, worry-free sale.

Preparing Documentation and Records

Photo by Anna Nekrashevich

Photo by Anna Nekrashevich

A well-organized file is your strongest selling point. Note buyers want reassurance that your promissory note is stable, enforceable, and worth the price.

Before listing your note for sale, make sure you:

- Gather All Signed Documents: Keep the original promissory note, security agreement (for secured notes), and any amendments.

- Show Payment History: Include payment receipts, bank statements, or ledgers that prove the borrower’s track record.

- Confirm Secured Status: If your note is secured, have collateral documents, UCC filings, or deeds of trust clear and accessible.

- Provide Contact Information: Include borrower and lender details for smooth communication.

- Disclose Any Defaults: Honesty about any late or missed payments builds trust and speeds up due diligence.

Organizing your file helps avoid delays and gives buyers the confidence to move forward. For a step-by-step checklist, see this helpful guide on preparing documentation for a promissory note sale.

Valuation Factors for Secured vs. Unsecured Notes

What makes one promissory note command a better price than another? Buyers put each note under a microscope to look for value, risk, and reliability—especially when comparing a secured promissory note to an unsecured one.

Key valuation factors include:

- Collateral Quality and Documentation: For secured notes, buyers review the type, location, and value of collateral. Real estate or vehicles as security usually boost value.

- Borrower Payment Record: A steady payment history signals lower risk and increases value. Late or missed payments can decrease your payout.

- Term and Interest Rate: Shorter terms and higher rates can be a plus, but only if the borrower has been consistent.

- Enforceability: Legal clarity is crucial. Secured notes with properly filed UCC forms or deeds of trust look better to buyers.

- Default Status: Buyers may offer less for notes in default, especially if the note is unsecured.

A secured promissory note, with backing from solid collateral, often sells for a smaller discount. Unsecured notes usually fetch less, as buyers take on more risk and must rely solely on the borrower’s promise. For additional details on buyer evaluation criteria, check this expert breakdown on how promissory notes are valued and sold.

Selecting Buyers and Navigating the Sales Process

After preparing your documents and understanding your note’s value, focus on finding reliable buyers and guiding the sale to the finish line.

- Vetting Buyers: Choose reputable note buyers with solid reviews and verifiable transaction history. Online platforms or specialized note brokers can help.

- Get a Legal Review: Before signing anything, consult an attorney experienced in promissory note sales. They’ll check the contracts and protect your interests.

- Negotiate Transparently: Share your full file and let buyers conduct due diligence. This speeds up final offers and avoids surprises.

- Close the Sale: Once you accept an offer, follow standard steps: sign an assignment agreement, transfer the note, and arrange payment (often with a notary or attorney involved).

- Comply with Legal Requirements: Follow local, state, and federal rules. This matters most for secured promissory notes tied to real estate or high-value assets.

Taking these steps can help you avoid fraud and disappointment while securing the best possible sale outcome. For more practical tips on working with buyers and legal requirements, see these tips on selling your promissory note.

A smooth sale comes from preparation, transparency, and picking trustworthy buyers. The right approach helps you unlock your note’s value and move on with confidence.

Conclusion

Choosing between a secured promissory note and an unsecured one impacts the value, risk, and speed of any sale. A secured promissory note stands out as the safer choice for most sellers, offering lower risk, stronger legal protection, and better selling power. Unsecured notes, while simpler, carry more uncertainty and tend to sell for less.

Before making a move, review your note’s paperwork and seek advice from an attorney or financial expert. Every situation brings its own set of details and risks, and getting proper guidance protects your interests.